WealthProtect Status Update April 2020

WealthProtect Status Update

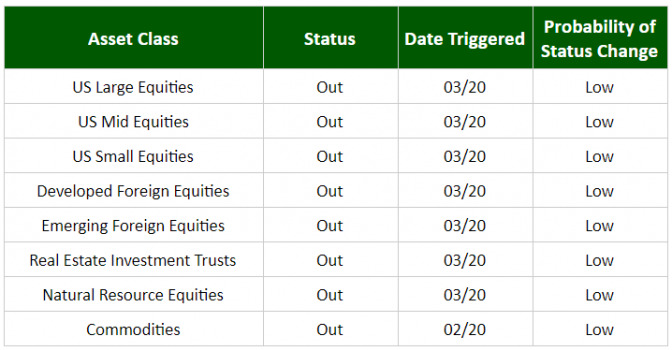

This is the monthly **Wealth**_Protect_ System* status update and includes the probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

All asset classes remain out despite the strong rally.

Market Commentary

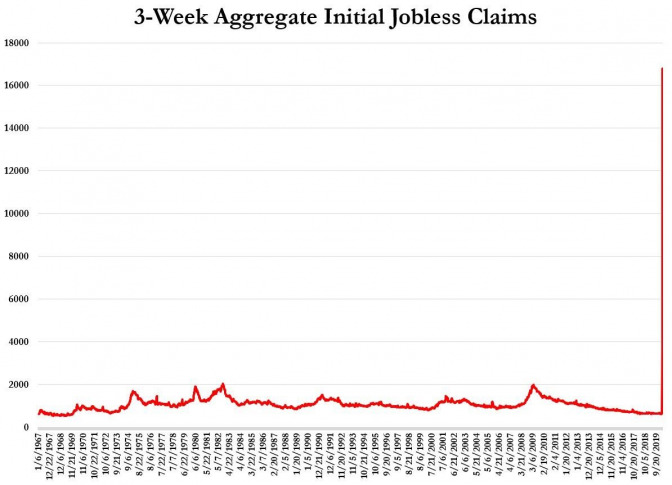

We have put a full stop to at least one-third of the US economy. First-time unemployment claims this past week were 6.6 million, following over 6.9 million the week before and 3.3 million the week before that. That is about 17 million new unemployed individuals in under a month. This compares with an average week of 215,000 two months ago and at the worst of the 2008 financial crisis of around 700,000. This is truly unprecedented. So far, in April, only 69% of renters made their rent payment compared to 82% in March. Many companies have notified landlords they will not make rent payments. Economic contraction estimates for the second quarter ranged from about negative 12% to 50%, with a loss of 30% now being the “expected” number. This is several times worse than the worst quarter of the Great Recession. For many sectors of the economy revenues and earnings have fallen off a cliff. The International Monetary Fund expects this to be the worst economic fallout since the Great Depression. Yes, the Federal Reserve and the Federal Government have stepped up to the plate to mitigate the damage with a variety of programs. While America may get back to work quickly once our self-imposed economic sanctions are lifted, the damage will likely be far longer lasting than many expect.

Portfolio Commentary

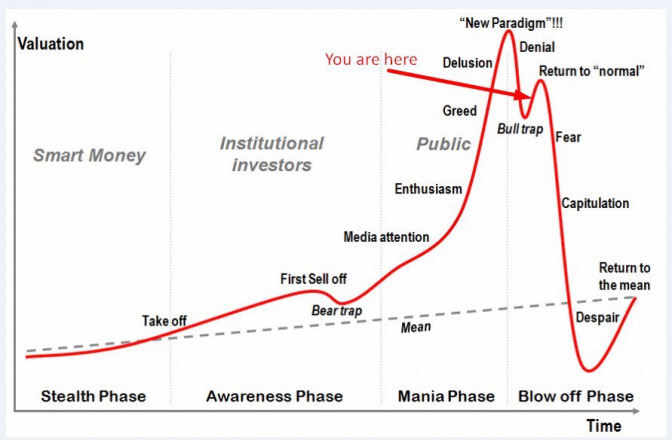

After dropping about 34% to a low on March 23rd, the markets have been on a decent rally. This has been enough for many to say the low is in and the worst in the markets is behind us. If this is true, it would be the first time in history that a market bottom has happened ahead of or very early in a recession. Re-read the economic commentary. My belief is this hasn’t been fully priced in. When the economic damage done to our country is recognized by market participants, it is likely we will revisit the March 23rd lows, and fairly likely we will exceed them. Bear markets don’t end on optimism and the FOMO (Fear of Missing Out) that many investors are feeling right now. Historically, bear markets end in despair when investors want nothing to do with stocks. Perhaps it will be different this time; I still doubt it. See the graphic below. This is how market cycles tend to go and where I believe we are in the cycle. Of course, I could be wrong. This is why we follow our system triggers.

Stay safe, and please call us if you have any questions.

Thanks for your continued trust.