WealthProtect Status Update: December 2014

WealthProtect Status Update

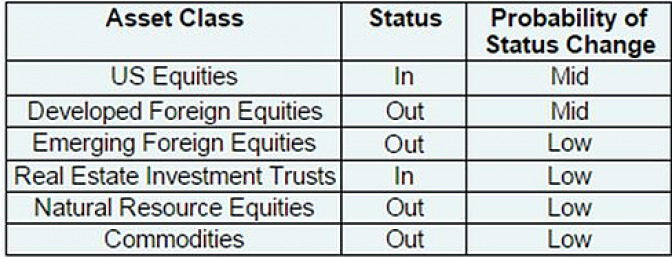

We email the status of our WealthProtect System* monthly and give probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month as well as changes in overall asset allocation.

Commentary

WealthProtect triggered this month. We triggered out of Emerging Foreign Equities. This means that our portfolios have approximately 50% fewer equities than when fully invested. This may seem odd as the US market continues to make new highs. Maybe the US is the only game in town and maybe it is different this time. However, when US large company stocks and Real Estate Investment Trusts (REIT's) are doing well, when bond yields are plumbing new lows, when the yield curve is flattening, and when riskier bonds have dropped significantly, we must be open to the possibility that something is brewing. As a reminder, the 2008 crash was 57% from peak to trough, the 1929 crash was 89%, and the Japanese stock market is still down 55% from its peak set in 1989! (Yahoo Finance) I have no clue whether we will have a crash, a modest correction, or a return of the bull run. Our WealthProtect System is non-emotional and it is telling us that at least outside of pure US equities, something is amiss. Stay tuned. Have a blessed Christmas!

Thanks for your trust.