WealthProtect Status Update: October 2014

WealthProtect Status Update

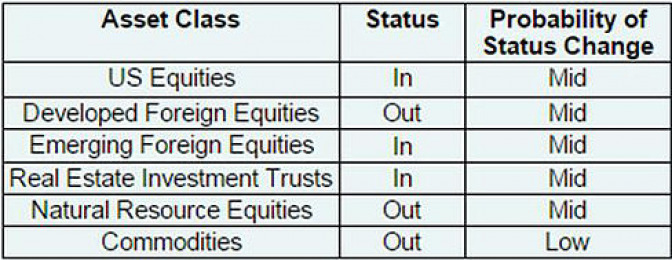

We email the status of our WealthProtect System* monthly and give probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month as well as changes in overall asset allocation.

Commentary

Volatility came back with a vengeance in September and early October. Commodities, natural resources, and foreign equities saw the largest declines. This was enough for both our natural resource equities and developed foreign equities to trigger out. Within domestic equities we saw modest declines in the popular averages, but underneath many stocks are already 20% below their recent peak. Our portfolios are now more defensively positioned as result of the triggers. As a reminder, our WealthProtect System seeks to reduce the risk of losing significant capital. It is not designed to manage the small declines (under 20%) of the market, but rather to help keep those declines from becoming truly wealth-destroying.

Thanks for your trust.