Other Points of View: March 2021

Reginald A.T. Armstrong • Other Points of View

Welcome to the Other Points of View, a monthly eZine designed to complement our WealthProtect Status Update. Other Points of View's primary aim is to give you in an easy, once per month format direct links to articles, blogs, and research that you may find valuable.

Please keep in mind that opinions shared via those links belong to those authors and do not necessarily reflect the views of LPL Financial or Armstrong Wealth Management Group. Enjoy!

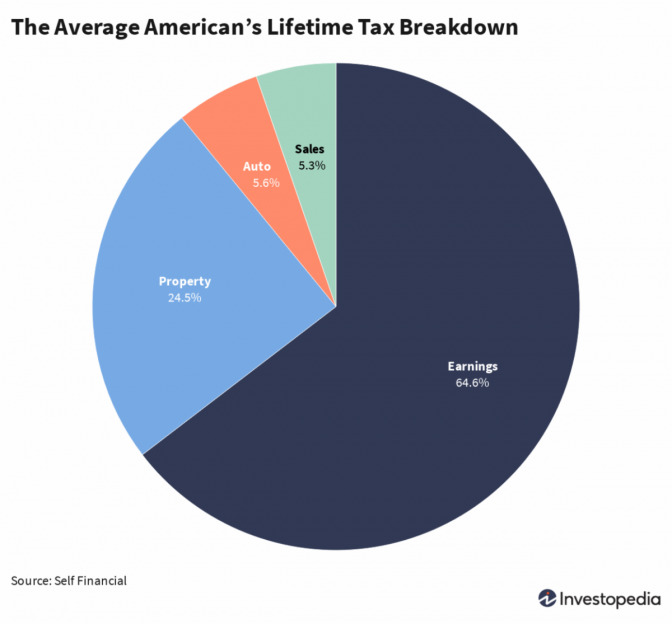

Investopedia: The Average American's Lifetime Tax Breakdown

Some state governors are proposing tax increases now that the coronavirus pandemic has punched a hole in their budgets, The Wall Street Journal reported. After accounting for federal aid, states might need to come up with approximately $56 billion in spending cuts or revenue increases to balance their budgets through the fiscal year, according to Moody’s Analytics.

Now that tax season is upon us, it's interesting to consider how much taxes we each will pay over the course of our lifetime. Based on expenditure numbers from the Bureau of Labor Statistics, the average American will pay $525,037 in taxes, or 34% of their income, over the course of a lifetime, according to a study from fintech firm Self Financial.

Of course, this figure varies greatly by state. Those in New Jersey will pay the most in lifetime taxes ($931,000), while those is West Virginia will pay the least ($321,000). In addition, the average American will spend close to $427,000 on personal spending (food, clothing, personal care, and entertainment), with 6.5% of that, or $27,761, going toward sales taxes.

Broken down on a yearly basis, Americans paid an average income tax payment of $15,322 in 2018 based on the most recent IRS data. Interestingly, in 2017, the top 50% of all taxpayers paid 97% of all individual income taxes, while the bottom 50% paid the remaining 3%.

So where do our taxes go?

The U.S. government collects over $5.3 trillion in taxes each year, which are used to fund public services, pay government obligations, and provide goods for citizens. To learn more about taxes, check out these stories: