Spring 2017 Newsletter: Quarterly Update

Reginald A.T. Armstrong • The Armstrong Report

It was a decent start to the year.

The Economy

The 4th quarter of 2016 limped in at 2.1% growth and preliminary estimates of the first quarter this year are about 1% according to the Federal Reserve Bank of Atlanta. What is known as “soft data” (think business and consumer optimism) has been fairly robust so far since the election. This has yet to translate into “hard data” (think actual capital expenditures, productivity, and consumer spending). In my opinion, how quickly the administration makes its tax proposal, how robust that proposal is, and how rapidly it is signed into law will make a fair amount of difference, especially for how business owners make decisions. The Fed Funds rate increase by the Federal Reserve in March was widely expected and has started to cause rates on Certificates of Deposit to rise again.

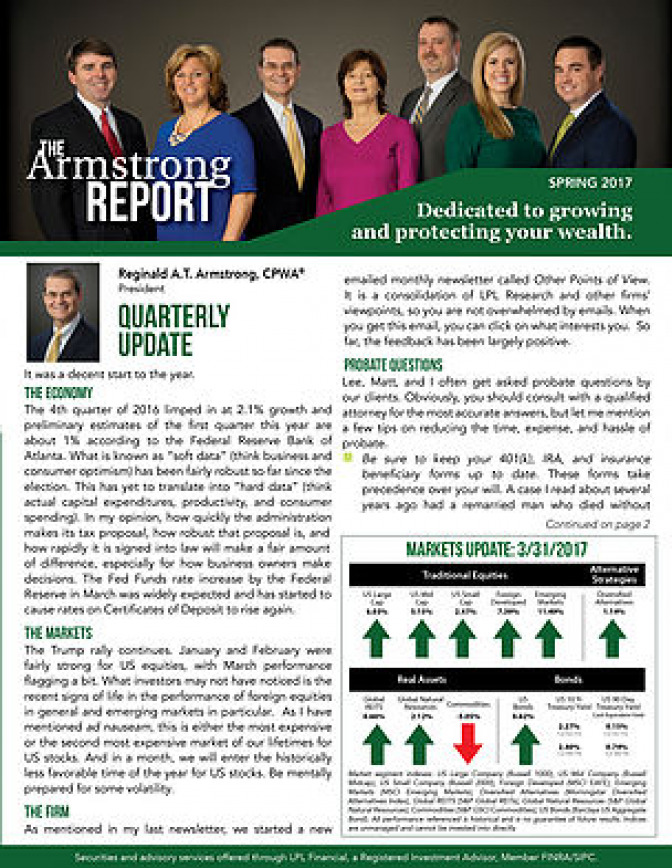

The Markets

The Trump rally continues. January and February were fairly strong for US equities, with March performance flagging a bit. What investors may not have noticed is the recent signs of life in the performance of foreign equities in general and emerging markets in particular. As I have mentioned ad nauseam, this is either the most expensive or the second most expensive market of our lifetimes for US stocks. And in a month, we will enter the historically less favorable time of the year for US stocks. Be mentally prepared for some volatility.

The Firm

As mentioned in my last newsletter, we started a new emailed monthly newsletter called Other Points of View. It is a consolidation of LPL Research and other firms’ viewpoints, so you are not overwhelmed by emails. When you get this email, you can click on what interests you. So far, the feedback has been largely positive.

Probate Questions

Lee, Matt, and I often get asked probate questions by our clients. Obviously, you should consult with a qualified attorney for the most accurate answers, but let me mention a few tips on reducing the time, expense, and hassle of probate.

- Be sure to keep your 401(k), IRA, and insurance beneficiary forms up to date. These forms take precedence over your will. A case I read about several years ago had a remarried man who died without changing the beneficiary of his 401k from his first wife to his current one. Despite his will specifying he wanted the current wife to get his assets, the 401(k) went to the ex-wife. The beneficiary form trumps the will (no pun intended).

- Under normal circumstances, have beneficiaries of an IRA be a live person, not a will. The reason here is that a spouse has the option to roll the IRA into their name and a non-spouse into an inherited IRA, thereby delaying taxation of all the assets if that is what the beneficiary prefers. Having the will as beneficiary complicates this and ensures your heirs will need an attorney to sort it out.

- Add a Transfer on Death or Payable on Death addendum to your non-IRA accounts. This allows the account assets to bypass probate and go straight to those you have designated on the form.

- If you have a child with special needs who is receiving disability benefits, be sure to consult with the appropriate attorney. Leaving money directly to a child receiving disability benefits could cause their benefits to cease. However, sometimes crafting what is known as a Supplemental (or Special) Needs Trust can enable them to receive an inheritance without losing their disability benefits.

- Lastly, spend it all! Ok, so this one is a bit tongue in cheek. But it does solve the probate issue! Thank you for your continued trust.