Wealth Protect Status Update: April 2016

Reginald A.T. Armstrong • WealthProtect Status Update

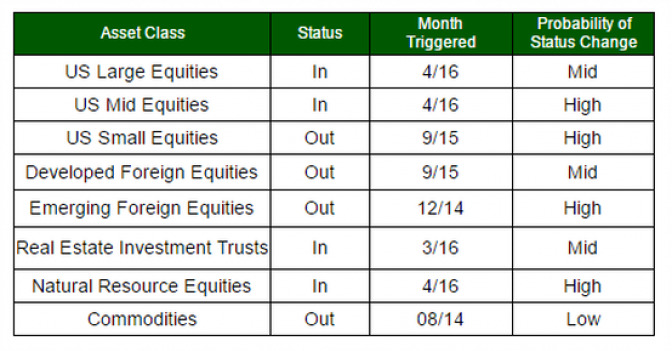

We email the status of our WealthProtect System* monthly and give probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month as well as changes in overall asset allocation.

Commentary

The rally continues and while I continue to believe this is a short-term rally, our rules-based disciplined did trigger three asset classes back in this month. US Large, US Mid, and Natural Resource equities all triggered in. This brings our typical portfolio's equity exposure to about 50% of normal. US Small caps, both developed and emerging foreign equities, and commodities remained below their trend lines, but emerging markets in particular are close to triggering. The re-entry into natural resource equities comes 18 months after we triggered out in October 2014 with the S&P Global Natural Resources Index at a much lower price. Real Estate Investment Trusts, by the way, have made good progress since our re-entry last month. That being said, it is still quite likely that this is a rally within a longer term decline. We will remain nimble.

Thank you for your trust.