Wealth Protect Status Update: February 2017

Reginald A.T. Armstrong • WealthProtect Status Update

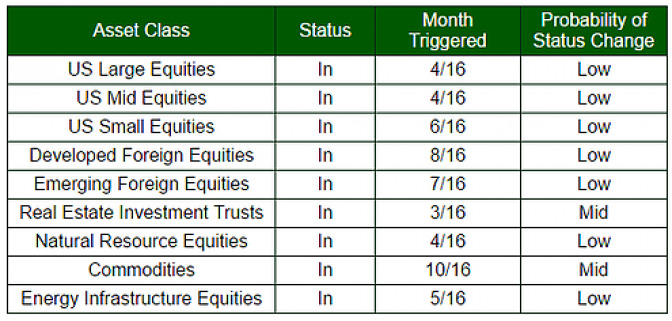

This is the monthly WealthProtect System* status update and includes the probability (Low, Mid, High) of a change in status within the next two months. Below is a commentary on actions taken this month as well as changes in overall asset allocation.

System Commentary

Starting with this edition, I will split my commentary on our system triggers from my market commentary. Once again, there are no trades in our WealthProtect System this month; we have been fully invested in equities since October 2016. Real Estate Investment Trusts and Commodities are the closest to exiting.

Market Commentary

While markets have risen over the past 30 days, market leadership has changed. For example, US growth stocks, foreign developed stocks, and foreign emerging market stocks, which were all weak since the election, have outperformed the broad market since the turn of the year. Similarly, bonds have strengthened some. US value stocks and natural resource stocks conversely have been a bit weaker.

According to 720 Global research, S&P 500 earnings have grown only 2.34% annualized over the past five years and -0.48% over the past three. Yet the S&P 500 has increased over 14% annualized over the past five years ending 12/31/16. There seems to be a disconnect, and we can see it in valuations. The S&P 500, using multiple measures, is trading at levels either never seen before or at the highest levels outside of the 1999-2000 internet bubble. From current valuations, a 40%-60% drop is not out of the question. If there is good news, it is that a number of asset classes, such as foreign stocks, do not appear to be as overvalued and may even be undervalued.

This is a dangerous time to be complacent and assume the US market will continue to go straight up. It is a time to check one's strategy, to make sure your portfolio is appropriately balanced, and that you have a rules-based risk management system like our WealthProtect in place.