Wealth Protect Status Update: March 2017

Reginald A.T. Armstrong • WealthProtect Status Update

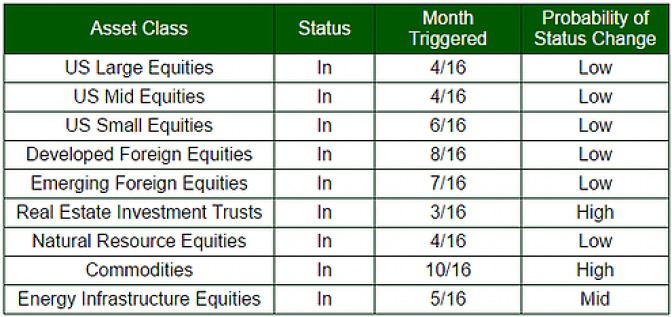

This is the monthly WealthProtect System* status update and includes the probability (Low, Mid, High) of a change in status within the next two months. Below is a commentary on actions taken this month as well as changes in overall asset allocation.

System Commentary

There are no trades in our WealthProtect System this month; but recent market weakness outside of traditional equities has brought a number of asset classes closer to triggering. Real Estate Investment Trusts and Commodities are the closest to exiting.

Market Commentary

The markets have seen a fair amount of rotation in the past several months. Before the election, large company value stocks were strong performers, followed by small cap stocks after the election. January had large growth stocks, foreign stocks, and real assets outperforming. With February came a strong S&P 500 performance while most other stock investments underperformed. So far, in March, equities seem to be retreating. On the bond side of life, the anticipation of a hike in the Fed Funds rate has hurt interest-rate sensitive investments. Of course, we don't know how things will play out, I just want to emphasize the importance of a diversified portfolio. The strength of the US stock market relative to everything else over the past few years leads to great temptation to concentrate money on what has been working so well. It will likely be a painful lesson indeed for those who decide to abandon diversification at these extremes.