Wealth Protect Status Update: May 2016

Reginald A.T. Armstrong • WealthProtect Status Update

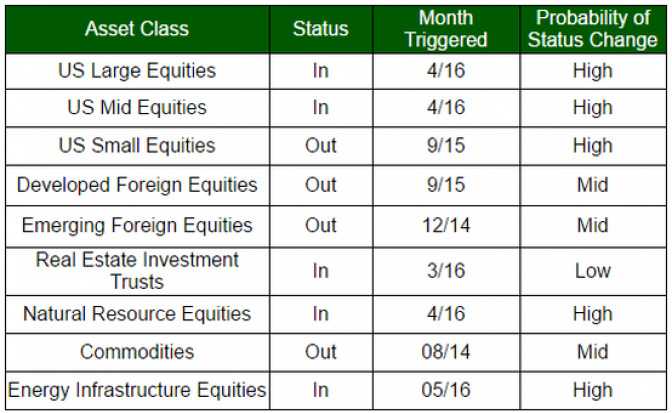

We email the status of our WealthProtect System* monthly and give probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month as well as changes in overall asset allocation.

Commentary

US Small equities continued to strengthen and are very close to triggering an entry position. Similarly, commodities have strengthened and the possibility of an entry within a few months is becoming more likely. Conversely, both developed and emerging foreign equities weakened a bit. Finally, I have added energy infrastructure stocks to this update, although we have been tracking them for several years. The exit trigger for these equities was back in 12/14 and this month triggered an entry position. While the overall market seems to be strengthening, my overall take is that real assets (real estate investment trusts, natural resource equities, commodities) and energy-linked assets appear to be improving after 18 months of weakness. The remainder of the US market, however, still seems to be in a topping formation with the overall trend being undetermined. Having entered the bumpier summer months, we may want to brace ourselves for some turbulence. Keep in mind, it is not the short-term wiggles that matter; it is the longer term gains and losses that make the real difference.

Thank you for your trust.