WealthProtect Status Update: September 2017

Reginald A.T. Armstrong • WealthProtect Status Update

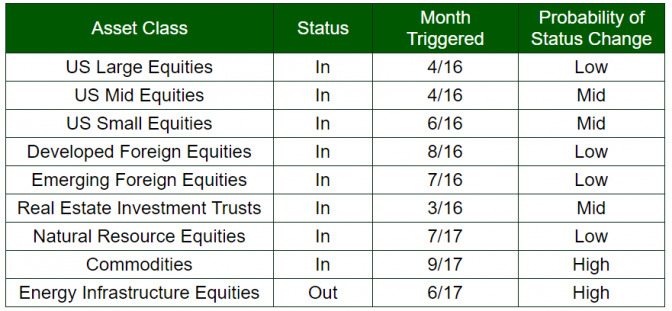

This is the monthly WealthProtect System* status update and includes the probability (Low, Mid, High) of a change in status within the next two months. Below is a commentary on actions taken this month as well as changes in overall asset allocation.

##System Commentary

Commodities, which have shown renewed strength the past few months, triggered back in. The majority of other asset classes, after a small drop due to tensions over North Korea and due to the potential costs of Hurricane Harvey and Irma, strengthened as well. Currently, we are only out of energy infrastructure stocks.

##Market Commentary "The trend is your friend," is a common, but a quite true comment on the markets. I have mentioned for some time how I believe the market is overvalued, that investors are complacent, and that monetary conditions are worsening to some extent. Despite these concerns, the market continues to power higher. Markets will do that. They will go higher than reason supposes in a bull market, and they will go lower than rational investors think possible in a bear market. Remember, the bull market of the late 90s was overvalued beginning by at least late 1996 when former Federal Reserve Chairman Alan Greenspan warned of "irrational exuberance." The top did not come until 2000, almost four years later.

This is why we invest using our trend-following strategy. It allows us to stay invested when the trend is positive, and allows us to exit when the trend is broken. It is unemotional and helps us stick to our discipline. While no strategy can guarantee success, or protect against all losses, we continue to believe that our strategy potentially leads to more predictable results.

Thanks for your continued trust.