WealthProtect Status Update April 2018

Reginald A.T. Armstrong • WealthProtect Status Update

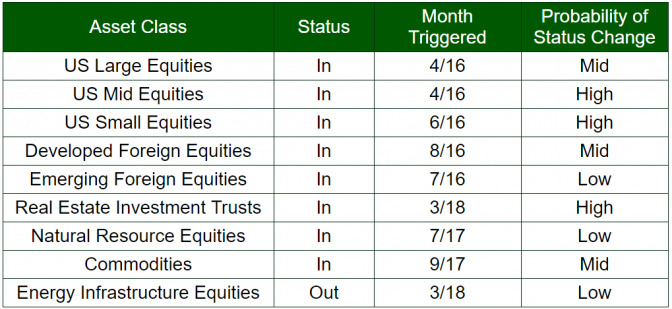

This is the monthly WealthProtect System* status update and includes the probability (Low, Mid, High) of a change in status within the next two months.

##System Commentary There were no triggering events this month. Most traditional equities weakened, while those linked to real assets strengthened. More on this below.

##Market Commentary

US and foreign equities weakened across the board this month, with US small caps within a 2% move of triggering out. Interestingly, most real assets (Real Estate Investment Trusts, Natural Resource Equities, and Commodities) strengthened. Only energy infrastructure equities were more mixed. Bonds, as measured by the Barclays US Aggregate Bond Index, also strengthened this month, but remained negative for the year.

This month I would like to give you an example of how our rules-based system works. Below you will find a chart of "a market" The jagged black line is this generic market's movement over the past three years. The red line is a trailing moving average of that price movement. Essentially, when the black line is below the red line on a decision day (once per month), this would indicate not being invested in the position. When the black line is above the red line, this would indicate being invested in the position. The green bar below shows when, in this example, the system would have called to not be invested. One thing I would like to draw to your attention: notice that the further the "market" rises, the more the red line rises as well. Consequently, the system has the potential to lock in profits (no guarantees, though).

This is a hypothetical example used for illustration purposes only and is not representative of any specific investment or scenario.

I hope this example helps. Thanks for your trust and call us if you have any questions.