WealthProtect Status Update April 2019

Reginald A.T. Armstrong • WealthProtect Status Update

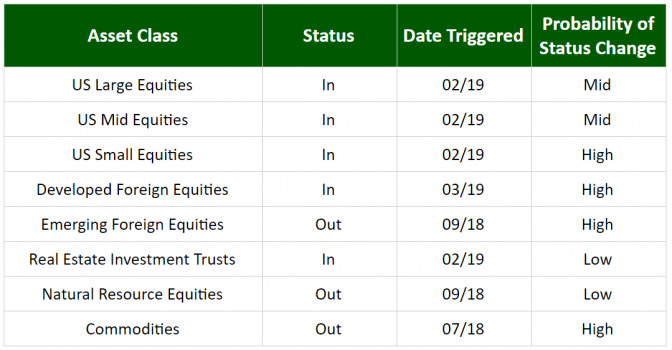

This is the monthly WealthProtect System* status update and includes the probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

##System Commentary Emerging Foreign Equities triggered in this month. All other equity segments strengthened as well. Our current models have a US Tilt, so we don’t have an explicit emerging markets position. Our current foreign investment is a blended investment that includes emerging markets.

##Market Commentary The S&P 500 as of 4/10/19 is still 1.8% shy of a new all-time high. While we need to eclipse the old high to confirm the drop at the end of 2018 was just a correction, it certainly appears that way.Keep in mind this tells you nothing about the valuation of the market. This by itself doesn’t mean the market is expensive or cheap or at a point of fair value. By all measurements that have a reliable correlation with future 10- or 12-year returns, the current market valuation is the most expensive in history except for the 2000 peak. This implies that 12-year returns will likely be about zero. The question is how do we get from here to there? In all likelihood, we will experience a significant bear market at some point and then work our way back up. We can’t predict when that will happen, but this is most likely not the time to take on more risk.If you have concerns about your risk exposure, give us a call.

Thanks for your continued trust.