WealthProtect Status Update: April 2023

Reginald A.T. Armstrong • WealthProtect Status Update

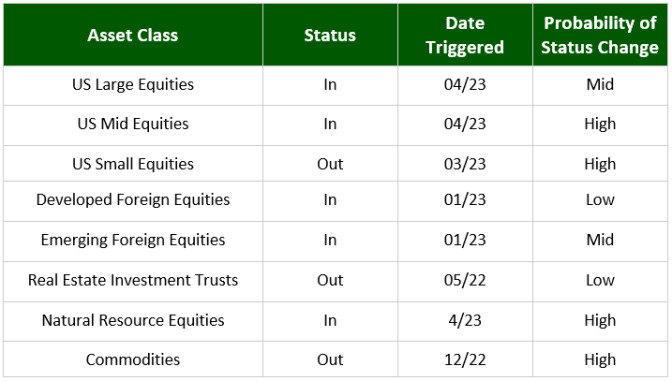

We email the status of our WealthProtect System* monthly and give the probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and the market in general.

System Commentary

Equity markets have been trading in a tight range, especially in large-cap stocks, for the past 3-4 months. The 2-4 week cycle is causing stocks to trigger in and trigger out. This month large-cap core, midcap stocks, and natural resource stocks triggered back in. Keep in mind that this does not necessarily reflect what we do in our portfolios. For example, we triggered into Large Cap Value stocks in January and have never triggered out. For large-cap core, there are several factors that point to potential weakness, so we will wait for confirmation before adding that asset class in order to avoid a whipsaw. Foreign stocks continue to outperform US stocks so far this year but by a narrow margin.

Economic/Market Commentary

The economic data continues to show a slowing economy, but not one falling off a cliff. Inflation is coming down but is proving far stickier than the so-called “experts” expected. The banking “crisis” of last month seems to have passed for now. One piece of good news is that during the crisis bonds, especially US Treasuries, acted as a safe haven once again. It is my opinion that if we don’t have a recession, bonds should do fairly well here. However, if we do get a recession, then bonds will likely do very well.

My bottom-line expectation on the economy is that we will enter a recession soon. At least that is what most of the data shows. However, it is possible that the flood of money into the system that caused inflation may have also distorted these measures and that we just get a soft patch instead of a recession. If there is no recession, stocks can probably rise here despite the markets not being cheap. If we get a recession, though, another leg lower would be expected.

Please call your wealth manager if you have any questions.

Thanks for your continued trust.