WealthProtect Status Update: August 2022

Reginald A.T. Armstrong • WealthProtect Status Update

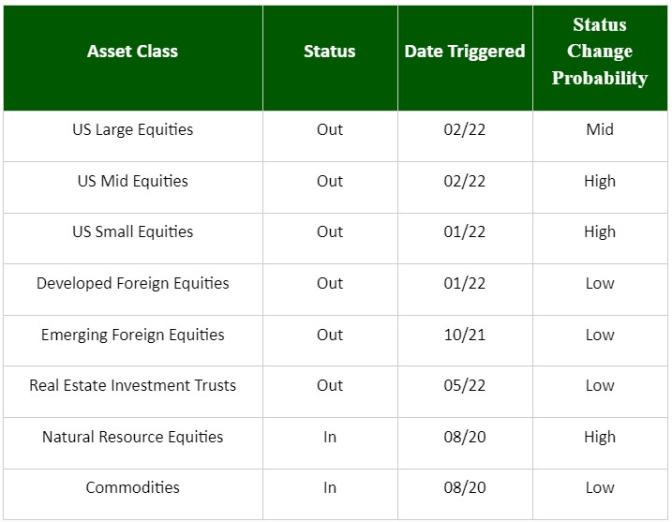

This is the monthly WealthProtect System* status update, where we include probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

There were no changes to triggers, but stocks had a strong rally from the market’s recent low on June 16th, bringing triggers in US equities much closer to triggering in. We will monitor weekly, so we re-engage appropriately as trendlines are crossed.

Economic/Market Commentary

While GDP was negative for the first half of the year, the story in the past 10 days has been inflation. Headline inflation (CPI) dropped from 9.1% to 8.5% and producer prices fell as well. Add to that the good headline employment number, the market rally continues in August.

Let’s talk about inflation. Inflation is primarily a monetary phenomenon. In 2020 and 2021 we increased the M2 money supply by an annual rate of 18% versus the more normal 6%. In addition, supply lines were disrupted by COVID lockdowns. The war in Ukraine exacerbated the situation. No wonder we have inflation; it shouldn’t have come as a surprise. For most of this year, the money supply growth has been back to the normal range and so we have been predicting peak inflation, although the peak was later than we expected. Between more normal money supply and people adjusting their spending due to high prices, we expect the rate of inflation to continue to drop, but to take up to 18 months to get back to the 2-3% range. Of course, renewed excessive spending by the government, as well as the dynamics of inflation (reining in inflation is much more difficult than causing it), could lead to a longer period of higher prices.

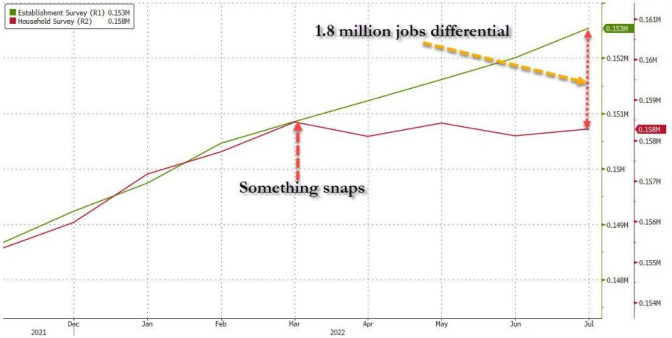

On the employment front, we are concerned about the data. In March, the establishment survey and the household survey diverged. The household survey (calls to real people) shows flat employment, while the establishment survey (adjusted data by the government) shows 1.8 million more jobs. Things may not be as rosy as they seem.

This market rally has been strong but is about average for a bear market rally (in my opinion, we are still in a bear market; but we react to the data, not my opinion). The market is back to pricing in perfection. If the data comes in weaker than expected, a pullback would be normal, even if the bottom has been made.

From a portfolio perspective for our risk-managed accounts, we are close to triggering back in as I mentioned above. In addition, the data has not been definitive enough to add back to bonds. As a reminder, we reduced bonds back in January. We will add back when we judge appropriate.

In the meantime, with the yield curve hinting at recession, we will stay nimble. Call your wealth manager if you have any questions or concerns.

Thanks for your continued trust.