WealthProtect Status Update: December 2020

Reginald A.T. Armstrong • WealthProtect Status Update

This is the monthly WealthProtect System* status update, where we include probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

No changes to the system, but after Real Estate Investment Trusts maintained their position above their trigger point, we initiated a full position. We still have an overall underweight to equities.

Economic/Market Commentary

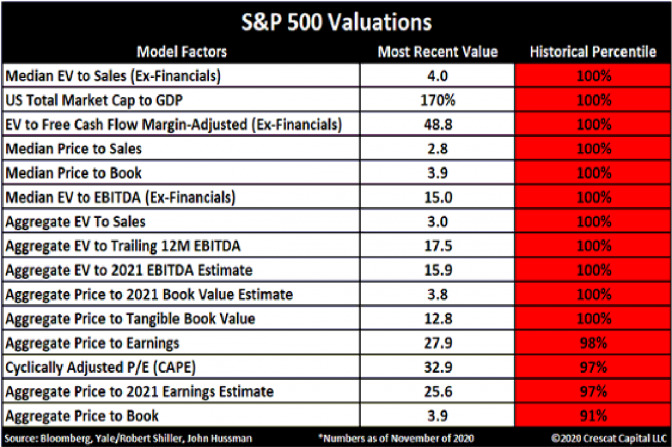

The market is priced for perfection and is now more overvalued than at any time in history except for a few months in 2000 by almost any metric. That doesn’t mean it can’t go higher in the short to intermediate-term; it does mean that for long-term buy and hold investors, chasing performance here might be rather dangerous. Below is a chart from DoubleLine Funds’ Jeffrey Gundlach illustrating that using most metrics, we are in the top 1% of historical occurrences in most of them.

Source: Bloomberg, Yale/Robert Shiller, John Hussman

S&P 500 Index is a capitalization-weighted index of the top 500 U.S. companies. One cannot invest directly in an index

EBIITDA = Earnings before interest, taxes, depreciation and amortization. P/E = Price/earnings. CAPE = Cyclically Adjusted PriceEarnings.

What this also means is that if you have had a conservative portfolio or a risk-managed portfolio the market surge is probably making you feel foolish for not being more aggressive. The above suggests patience will be rewarded. However, if your frustration causes you to want to change to a more “always invested” approach as opposed to risk-managed, please let your wealth manager know.

Thanks for your continued trust.