WealthProtect Status Update: December 2021

Reginald A.T. Armstrong • WealthProtect Status Update

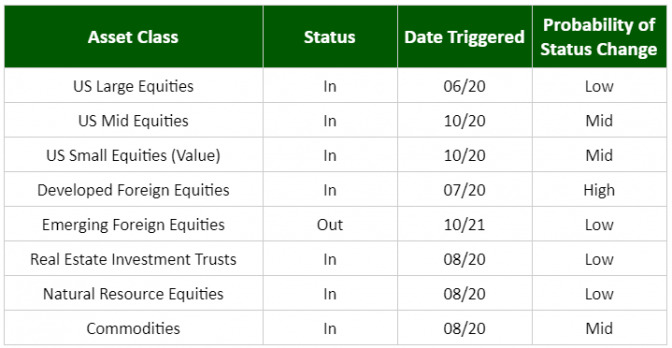

This is the monthly WealthProtect System* status update, where we include probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

No triggers this month, but it was close the week of 11/29-12/03. The decline in the markets brought us almost to selling both developed international and large cap value positions. The rebound the following week kept that from happening.

Economic/Market Commentary

The economy seems to be ending the year on a strong note, but the specter of Omicron and inflation are making most of the headlines. The biggest risk to the economy is likely inflation and a rising interest rate environment. In my opinion, inflation will remain high but will begin to come down by mid-2022. It probably won’t be back to where it was a few years ago, but should be more manageable.

Inflation is also the biggest known risk for the stock market. We must keep in mind, however, the unknown risk—Russia invades Ukraine, a deadlier new variant of COVID, something we haven’t even considered. One of these could stop the advance.

It is human nature to seek understanding. We want to see a cause. And while previous bear markets certainly had causes, there wasn’t a bell ringing at the top of the market. Why in 1929, 1987, 2000, or 2007 did the markets stop rising and then began what eventually was an ugly bear market? There isn’t an event on the day of the peak or the month that caused the market to stop rising. What’s my point? The top of this market, whenever it may be, will likely not have some catalyst that we can all point to. Therefore, make sure your strategy is in line with your expectations. Check with your wealth manager if in doubt.

Have a Blessed Christmas and a truly fantastic 2022!

Thanks for your continued trust.