WealthProtect Status Update: February 2022

Reginald A.T. Armstrong • WealthProtect Status Update

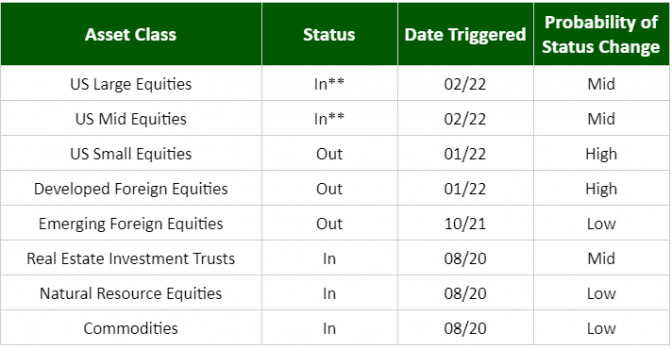

This is the monthly WealthProtect System* status update, where we include probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

The sharp drop in stocks in mid-January caused US Large Cap core (but not value) stocks, mid-cap stocks, small-cap stocks, infrastructure stocks, and developed foreign stocks to trigger out. However, the expected reflex rally did signal large-cap core and mid-cap stocks to trigger back in several weeks later. In our portfolios, we sold the above, but in February added to large value equities as they have held up better. If large core stays above its trigger point for a few days, we may add back to this asset class.

**Asset class triggered out and back in within 30 days.

Economic/Market Commentary

After a strong December, traders woke up in January and the market fell out of bed in the second and third weeks due to the realization that the Federal Reserve is way behind in fighting inflation and that rate increases might be more than what was expected. The big news, however, is that inflation increased to 7.5% in January on an annualized basis. That being said, we are likely close to peak inflation. 12-18 months ago, I was mentioning in client reviews that the M2 money supply had increased to 25% year over year, about double any prior period going back to 1960. The inflation of this year, in my opinion, is a direct result of this, but made worse by the supply chain issues. One reason I believe inflation will likely be 4-5% by mid-year is that while the supply chain is still not normal, M2 is back to normal levels. However, it will likely take 12-18 months to get to 2-3% inflation.

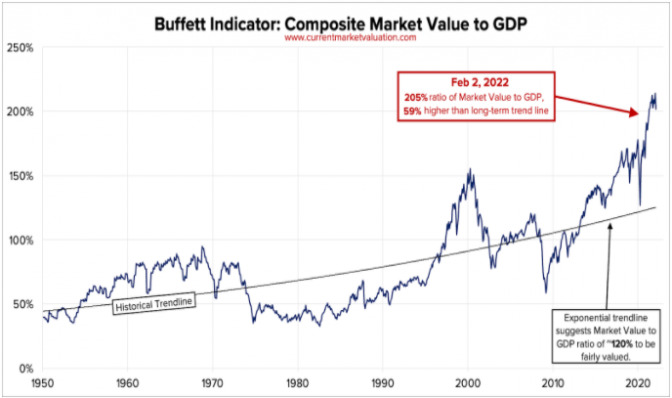

While it is painful to exit out of stocks only to trigger back in, with an expensive market (see graph below) prudence dictates following our risk management rules. Let your wealth manager know if you have any questions.

Thanks for your continued trust.