WealthProtect Status Update January 2020

Reginald A.T. Armstrong • WealthProtect Status Update

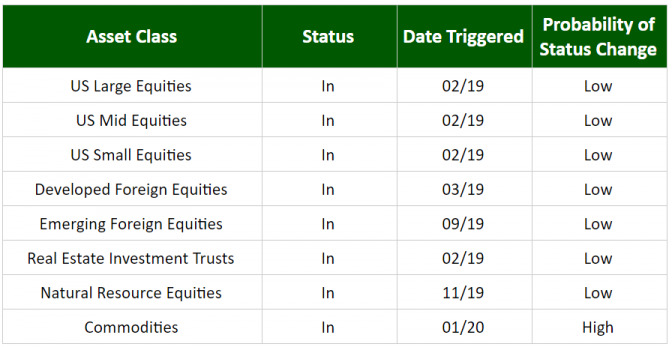

This is the monthly WealthProtect System* status update and includes the probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

##System Commentary Commodities triggered in. Currently, we are using commodities only in our Christian Values Portfolio. Portfolios are fully invested with their maximum equity allocation.

##Market Commentary The markets continued to power higher, reaching new highs, despite various political concerns and the geopolitical worries raised over Iran. It is natural to think that a major geopolitical event such as Pearl Harbor, the Cuban Missile Crisis, or 9/11 will lead to disastrous market results. Therefore, many investors want to rush to safety. However, that is not what the data shows. In fact, for the 20 geopolitical events going all the way back to the Pearl Harbor Attack, the average total drawdown in the stock market is about 5%. In fact, the drop only lasts an average of three weeks, and the markets are back to where they were before the event in about six weeks. The worst was Pearl Harbor with a drop of almost 20%; even that one took less than a year to get back to break even—in the middle of a world war! (Past market performance like this, however, does not guarantee future results.)

The reason, my friends, probably is because geopolitical events rarely negatively impact the broader economy and corporate profitability. The bottom line for us is to stick to your strategy and not let the daily headlines cause you to get off track. Give us a call, of course, if you have any questions.

We wish all of you a Happy New Year.

Thanks for your continued trust.