WealthProtect Status Update: January 2021

Reginald A.T. Armstrong • WealthProtect Status Update

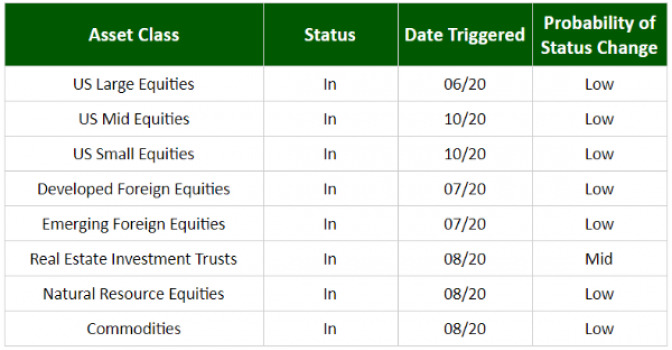

This is the monthly WealthProtect System* status update, where we include probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

No changes to the system.

Economic/Market Commentary

The economy continues to recover but will likely not exceed the pre-pandemic peak until late this year. Vaccines will surely help to a more robust and widespread recovery, but with corporate earnings down 33% in 2020, there is a lot of ground to make up. This morning’s (1/14/21) weekly jobless claims jumped back up to almost 1 million. Inflation is beginning to pick up, especially in groceries and building materials.

The market has zipped up so fast in the past few months that many sectors are 20-30% above their longer-term moving averages. Historically this has meant short-term sharp drops (regardless of whether it is the beginning of a crash or just a correction). Expectations of more stimulus from the Biden Administration has also led to bond yields increasing sharply. While we are still underweight stocks in our risk-managed portfolios, we rebalanced many accounts due to the sharp moves in stocks and bonds of late.

Tax Note

We don’t know what the tax landscape will look like, just that taxes won’t be lower. The top tax rate on regular income is almost certainly going back to 39.6%. The corporate tax rate is likely to rise from 21% to around 28%. The limit on state and local tax deductions will likely double from $10,000 to $20,000. Capital gains rates will also likely rise, and the estate tax exemption will likely be lowered by about half. There is also, however, some conversation on raising the age for Required Minimum Distributions (RMD) from 72 (recently raised from 70.5) to 75. We will see. More to come when we actually know. By the way, for now, RMDs are back. You could skip them in 2020 due to the pandemic, but not in 2021.

Thanks for your continued trust.