WealthProtect Status Update: January 2023

Reginald A.T. Armstrong • WealthProtect Status Update

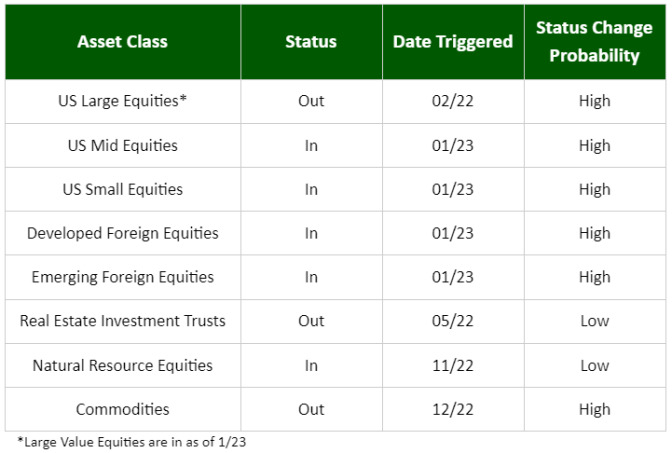

This is the monthly WealthProtect System* status update, where we include probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

Large Value, small value, developed foreign, and emerging market stocks all triggered in due to recent strength combined with the moving average “trigger line” moving down.

Economic/Market Commentary

The inflation rate continues to come down. The odds of a recession this year, in my opinion, continue to be fairly high. However, while unlikely, there is always the possibility the Federal Reserve engineers a soft landing, and we just have a soft patch instead of a full-blown recession. If we get a recession, more stock market pain is likely; if we bypass a recession, stocks may stabilize here. Bonds should do well in both scenarios, with greater gains in a recession. This uncertainty is why we stick to our methodology.

Therefore, in many of our portfolios, clients will find we have added to large value, small value, and foreign stocks (both developed and emerging). If we head back down, we will be out again. However, if the market zips up, we will be able to participate. Also, a year ago, we reduced bonds by 40%. We have put half of that back into bonds.

I don’t want to get too much into the weeds. Please call your wealth manager if you have any questions.

Thanks for your continued trust.