WealthProtect Status Update July 2018

Reginald A.T. Armstrong • WealthProtect Status Update

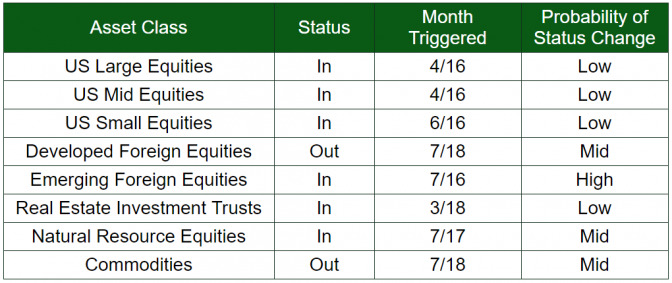

This is the monthly WealthProtect System* status update and includes the probability (Low, Mid, High) of a change in status within the next two months.

##System Commentary Stocks weakened substantially this past month, especially outside the US. This caused us to trigger out of Developed Foreign Equities and Commodities. We entered foreign stocks in mid-2016 and they have enjoyed good upside until the recent weakness. Commodities are a mixed bag. Energy related commodities and commodity indices that are oil heavy such as the S&P GSCI (70% oils) have done well this year. Just about all other commodities have been weaker, even metals. Consequently, more evenly allocated commodity indices such as the Bloomberg Commodity Index (which has only about a third in oils) have not done nearly as well. While I continue to believe foreign equities are fairly valued and that commodities are due for a major upswing, our system is designed to take the emotions out of the equation, so we follow our discipline.

##Market Commentary

I believe the markets are coming to an important juncture and will likely break out of this trading range soon. The direction, however, is unknown. Whether the market goes up on expected economic strength, or goes down due to trade/tariff concerns, this will likely also have an impact on bond yields. Due to this short-term uncertainty, our portfolios will temporarily have higher levels of cash. Cash, properly managed, can also be a valuable tool in the risk/return equation.

Thanks for your continued trust.