WealthProtect Status Update July 2019

Reginald A.T. Armstrong • WealthProtect Status Update

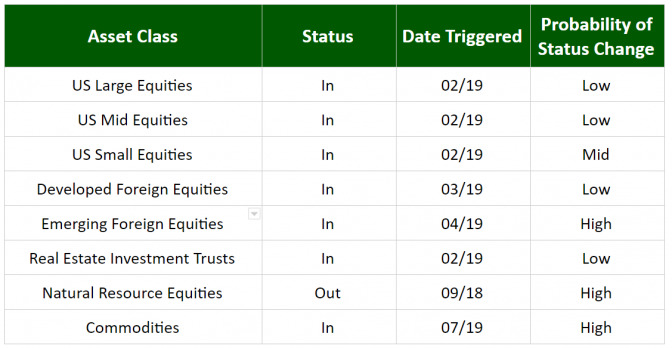

This is the monthly WealthProtect System* status update and includes the probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

##System Commentary There was one triggering event this month thanks to the strong rally in June and so far in July. All classes strengthened, with Commodities triggering in. Not all models have commodities.

##Market Commentary June was a very strong month and that has continued so far in July with most indices making new highs. Equity markets are up very nicely this year as measured by most indices. However, this recent strength can fool you if you don’t take a slightly longer view. The truth is the stock market is up mildly over the past 12 months and just a bit above—finally—the 1/26/18 high. Going sideways for 18 months is not exactly scintillating. Nonetheless, if we take an even longer view—three years, for example—the returns appear much more in line and reasonable.

So, is this the next leg of the bull market, or an extended topping process? My take is that it is too early to tell. The bond market, as measured by the 10-year Treasury yield, continues to be around the 2% mark—down from over 3% just nine months ago. That, combined with the continued yield curve inversion, says to me that while the light hasn’t turned red yet, it has turned yellow. Caution should be our watchword.

Thanks for your continued trust.