WealthProtect Status Update July 2020

Reginald A.T. Armstrong • WealthProtect Status Update

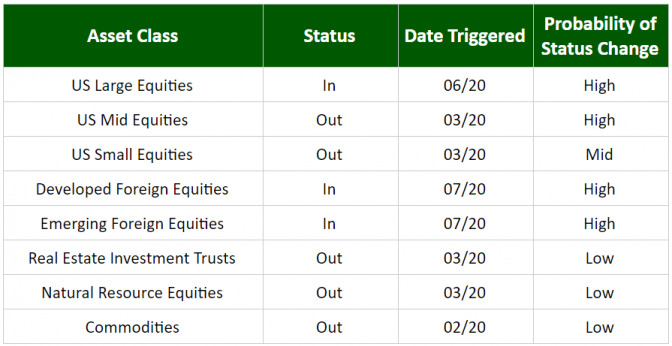

This is the monthly **Wealth**_Protect_ System* status update and includes the probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

Developed foreign equities barely triggered in and emerging markets triggered in.

Economic/Market Commentary

The second-quarter GDP will likely come in at -35% or thereabouts. While we have a recovery underway, already we are seeing renewed slowdowns in air traffic and restaurants as COVID-19 makes a resurgence in several states as the economy has opened back up. The stock market has traded in a range the past month (actually down about 2% from June 7th close to July 8th close). The market is basically a story of several tech stocks that are defying gravity while other stocks meander. In my opinion, the market is pricing in the best of circumstances. The economic reality is likely less than that. The market risk from this, especially from what will likely be dismal earnings, and election uncertainty may start to weigh on the market more in the months ahead.

Portfolio Commentary

Since large caps are still triggered in, we added another sleeve of large cap stocks. We are now at 75% of our normal large cap allocation. Since foreign stocks triggered in we also added to this asset class, but only 1/3 of normal exposure since developed stocks are right on the trigger line. We also added to our exposure in longer-term treasuries and gold to hedge the risk. We will continue to monitor on a weekly basis.

Thanks for your continued trust.