WealthProtect Status Update: July 2021

Reginald A.T. Armstrong • WealthProtect Status Update

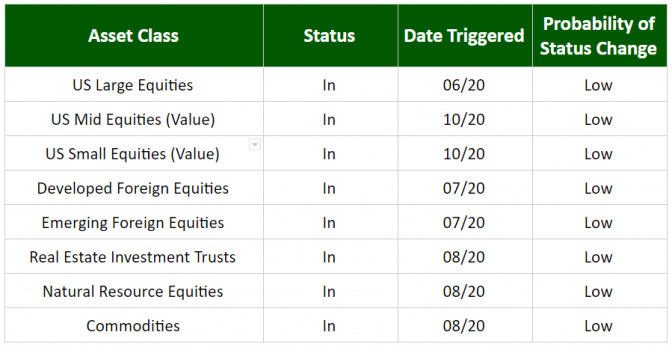

This is the monthly WealthProtect System* status update, where we include probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

No changes to the system.

Economic/Market Commentary

It appears that the economic numbers for the first half of 2021 will come in particularly strong, and that’s not just in comparison to a weak first half of 2020, but even in comparison to 2019. That being said, there are signs of slowing down to a more normal growth rate in the second half. Perhaps the 60% drop in lumber prices and the recent drop in Treasury yields are forecasting this. While inflation has been a significant concern in recent months, the real question is whether the 30% increase in the money supply since January 2020 will cause inflation to be “stickier” than the Federal Reserve expects or will a slowing economy due to high debt levels offset it. Hard to tell yet.

By the way, one “benefit” of the recent spike in the inflation rate is that the cost-of-living increase to Social Security Benefits in January will likely be in the 5% range. That figure is usually released in October.

As far as the markets go, the short run momentum is still to the upside. Any market weakness seems to be over in less than a week. The backdrop, however, has not changed. This is the most expensive market in recorded history on most measures. The pendulum will eventually swing the other way. Stay diversified, stay focused, and contact your wealth manager if you have any questions.

Thanks for your continued trust.