WealthProtect Status Update June 2020

Reginald A.T. Armstrong • WealthProtect Status Update

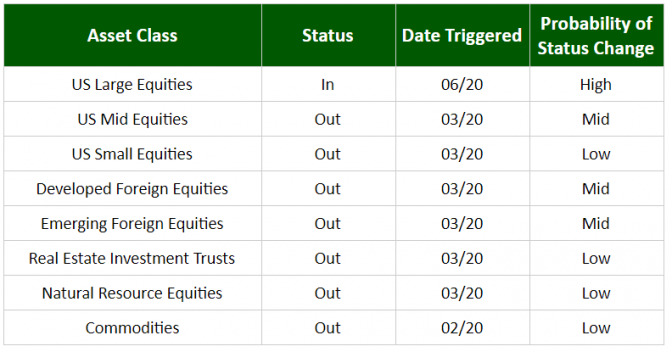

This is the monthly **Wealth**_Protect_ System* status update and includes the probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

Technically as of Wednesday’s close, our typical large-cap, mid-cap, and small-cap investments triggered in. However, if you measure using the index and include Thursday’s action, only large cap stocks triggered in.

Economic Commentary

As of the end of May and the first week of June, we have the most expensive market ever, rivaled only by the Nasdaq in 2000, but the economic data is among the worst ever, except for the Great Depression. Add to this that we are in a recession, the ton of COVID uncertainty, civil unrest, election uncertainty, and the most irrational exuberance I have seen since 1999 (Robinhood platform traders trading bankrupt stocks like day traders did dot coms in 1999, tons of signals at extremes not seen since 1999 or ever), and there is plenty of reason to be very cautious here. Yet, the markets have zoomed up and crossed key technical levels indicating this the crash in March might simply be a steep correction, not the beginning of the next bear market.

Market Commentary

We are faced with two challenges: do we trade in since our signals have been crossed, or do we ignore our trigger since the market seems poised for a massive decline? I have decided to take a hedged approach. First, while trading monthly has historically been the wiser method, the actions of the Fed indicate a weekly trade is more appropriate. Effective immediately and for the foreseeable future, we will review trading decisions weekly. Second, while our trigger indicated going into large cap stocks, which are 40% of our stock allocation, we traded only 25% of that. For example, if you normally have 60% in stocks, 24% would normally go into that investment. We traded only 6% of the account. The market on Thursday, June 11th, dropped right at the trigger line. If it stays above the line, we will probably add to this position. If it drops and stays below it, we will get out. Third, due to the very expensive nature of the markets, we also added for most accounts a position in long term Treasuries (which tend to do well when stocks get clobbered) and a position in gold (to diversify against chaos). Finally, we re-balanced the bond portion of our portfolios for the current environment.

The market’s path is unknowable. The market’s moves and our decisions may work out great for us, or they may work out not as well as hoped for. Keep in mind in all we do, we know we may lose a battle or two. Our entire focus, however, is to win the war. This means attempting to manage capital against very large declines while participating meaningfully in the long-term upside potential of the markets in order to help you pursue your goals.

Thanks for your continued trust.