WealthProtect Status Update: June 2021

Reginald A.T. Armstrong • WealthProtect Status Update

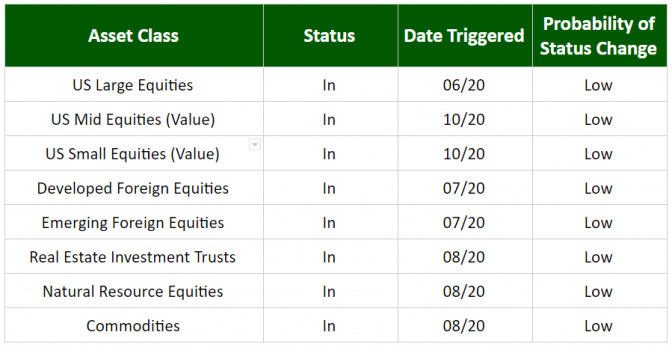

This is the monthly WealthProtect System* status update, where we include probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

No changes to the system.

Economic/Market Commentary

The economy continues to look fairly strong so far this year, with the biggest news being the dramatic pickup in inflation. This past Thursday’s release of the Consumer Price Index (CPI) showed a year over year increase of 5%. We can see it in groceries, lumber, real estate prices, and rents. Here is a comment by LPL Research on the especially huge pickup in car prices:

We continue to see strong evidence that supply chain bottlenecks paired with a rapid demand rebound are causing major price increases. The most visible example is in used car and truck prices, which surged 7.3% in May following a historic 10% rise in April. The supply of new vehicles is constrained in the near term because of semiconductor chip shortages, and as a result, used cars and trucks are being bid up in the secondary markets. The good news is that we expect these market imbalances to largely resolve themselves with time as supply, which has a longer ramp-up time than demand, recovers.

My take is that while the rate of inflation may prove temporary, most of the effects won’t be. Grocery prices, by and large, won’t come back down for example. I remember when in the late 1970s inflation reached 10% it took Paul Volcker, the Federal Reserve Chairman, raising the Prime Rate to 21.5% to break inflation. It worked, but caused a recession in the early 1980s. What’s my point? If inflation ends up being persistent, how will the Federal Reserve combat it when the government has so much debt it can’t afford for interest rates to rise much? And, how will markets react?

In some of our portfolios, we have Real Estate Investment Trusts, Gold, and Treasury Inflation-Protected Securities (TIPS) which tend to do well when inflation picks up. We will likely add other assets linked to inflation if these investments begin broadly outperforming others. In the meantime, stay diversified and don’t get caught up in some of the zaniness out there.

Thanks for your continued trust.