WealthProtect Status Update: June 2022

Reginald A.T. Armstrong • WealthProtect Status Update

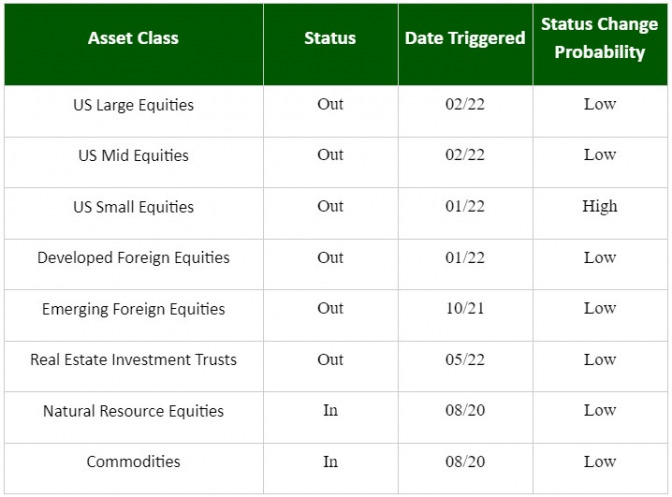

This is the monthly WealthProtect System* status update, where we include probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

There were no changes to triggers, although equities across the board have strengthened over the past month. US small value is particularly close to triggering in.

Economic/Market Commentary

GDP was down 1.5% in Q1 and is projected to be up only 0.9% in Q2 as of June 9th. Warnings from retailers such as Target and a variety of changing economic indicators suggest the economy is slowing down rapidly. Recession risk is real, but not certain. Inflation risk is also real (although a recession will likely cure that). The bottom line is there are several current and rising economic risks. The market declines and rallies certainly resemble what you get in a bear market, but we can’t be certain we are in one yet. It will likely be smart for investors to be prudent and well-balanced in their portfolios.

Portfolio Thoughts

Keep in mind that while I share our WealthProtect triggers in the major asset classes, this doesn’t mean we are investing exactly that way. For example, despite Large Caps triggering out in January/February, we still have a large value position that is doing reasonably well. At the portfolio level, we look at the actual investment, not just the asset class. Similarly, we are accessing exposure to commodities and natural resources through two momentum/rotation investments. Both holdings have the ability to rotate into different sectors of the market based on relative investment performance. I know that is probably a little too much “inside baseball”, but I thought some of you might like to know.

Give your wealth manager a call or shoot him an email if you have any questions. Thanks for your continued trust.