WealthProtect Status Update: June 2023

Reginald A.T. Armstrong • WealthProtect Status Update

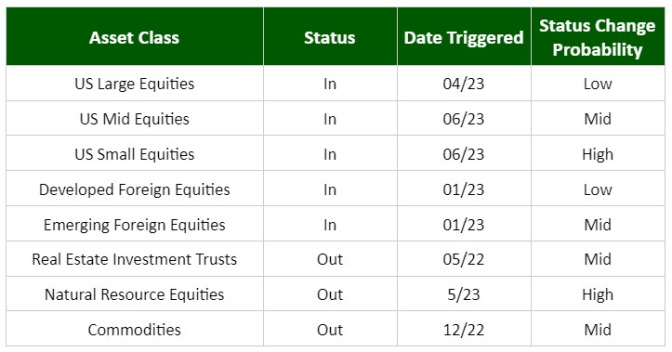

We email the status of our WealthProtect System* monthly and give the probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and the market in general.

System Commentary

Midcaps and smallcaps triggered back in as the see-saw in the markets continued. While most of the advance in stocks is due to a handful of stocks, it is enough to trigger those classes back in. The technical action is bullish, but the market is overbought here and a pullback is likely.

Economic/Market Commentary

With the debt ceiling debacle behind us, more economists are lowering their odds of recession, or are pushing out the timing of it. Interestingly, LPL Financial Research is increasingly calling for a recession beginning within six months. I believe the data still points to a recession, but if after a pullback stocks are still in a “triggered in” position, then we are likely to increase our stock allocation appropriately.

Thanks for your continued trust.