WealthProtect Status Update: March 2022

Reginald A.T. Armstrong • WealthProtect Status Update

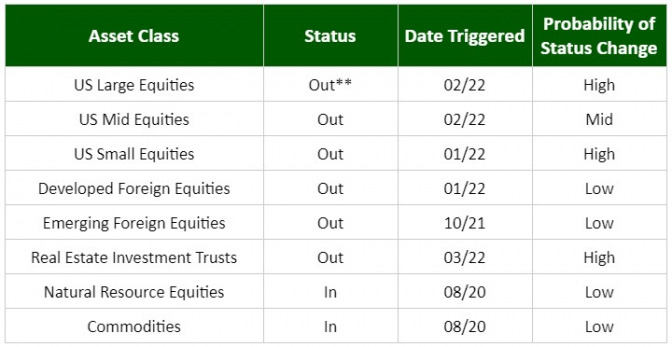

This is the monthly WealthProtect System* status update, where we include probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

**Large Value is still in

System Commentary

Stocks went back and forth as the war in Ukraine progressed but became decisively more negative as we began March. We triggered out of Global Real Estate equities. Large Value stocks are closer to triggering out, but still in.

Economic/Market Commentary

Stocks, as measured by the S&P 500 and Dow Jones Industrial Average, entered an official 10% correction in March while the Nasdaq and Russell 2000 Small Stock index both crossed the 20% “bear” market line. European equities were also hit viciously. However, commodities—especially oil—and precious metals rose. While their move is in part due to inflationary pressures, much of it is also due to the fear that comes with war uncertainty. When on March 9th it appeared that an agreement between Russia and Ukraine was more likely, US stocks rose, and the Bloomberg Commodity Index fell almost 8%! Emotions are pushing a lot of the market prices right now; it is important to stay dispassionate. We will likely add commodity type investments to our portfolios, but we are waiting until passions cool.

If the war escalates further, you can expect equities to do poorly while commodities will likely continue to rise. Bond yields, which have been in a range during this period, will likely drop if market fear picks up and the outlook for growth worsens. Keep in mind that as of March 8th, the Federal Reserve Bank of Atlanta expects economic growth to only be 0.5% in the first quarter.

If a truce or other resolution to the conflict comes about, then you likely will see stocks soar while commodities retreat, at least temporarily. Bond yields would likely rise some as well.

Keep in mind that crises are temporary, so market rebounds are to be expected. Also keep in mind, that the broader backdrop is even more important. For example, when the Cuban Missile Crisis occurred, stocks dropped and then rebounded quickly after the resolution of that crisis. Stocks then went on to make further gains in the next 12 months. It was a crisis within a bullish environment. When stocks dropped 12% after 9/11, they regained that loss in about a month, but were lower a year later. Why? Because the crisis happened in the middle of a bear market.

There’s no way to know whether we are in the beginning stages of a bear market, but it is beginning to smell like one. Slowing growth, a Fed that will likely raise rates, an oil shock (oil price shocks of 50% increases like we have just experienced have commonly led to recessions), and an expensive market starting to break down are all signs that point to the possibility. Once most investors become more concerned, as Will Rogers once quipped, on the return of their money rather than the return on their money, then it is “Katie bar the door.”

Let your wealth manager know if you have any questions.

Thanks for your continued trust.