WealthProtect Status Update May 2020

Reginald A.T. Armstrong • WealthProtect Status Update

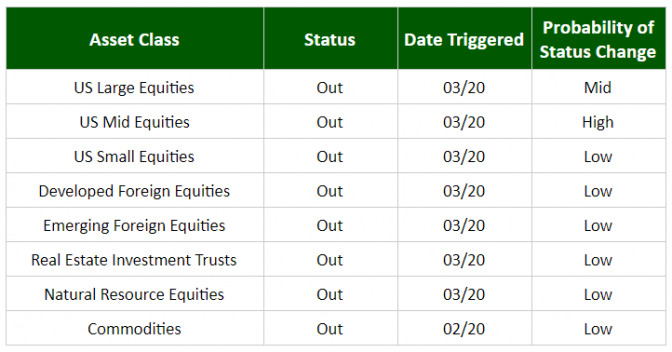

This is the monthly **Wealth**_Protect_ System* status update and includes the probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

All asset classes remain out, although midcaps were on the verge of triggering in.

Economic Commentary

Economic inactivity probably bottomed in mid-April. May will be horrible, but less bad than April. Hopefully, we will see “green shoots” of economic activity in June. We expect the April-June quarter to be the worst since WWII and probably since the Great Depression. That being said, the third quarter should show signs of a resurgence. A lot depends on how the “re-opening” of America and potential renewed COVID-19 cases turn out.

Market Commentary

After dropping about 34% to a low on March 23rd, the markets have rebounded about 31%. This is such a strong rally that many are calling it the beginning of a new bull market. Maybe. I believe the jury is still out, and more than likely this will turn out to be phase 2 of a 3-phase bear market, as I illustrated last month. For example, after peaking on September 3, 1929 the market dropped about 48% to mid-November. It then went on a tear with a 48% rally (this still left accounts down over 23% as bear market math is rough). This convinced many investors that the bear was over with. This did not prevent the third leg from taking place, and eventually the drop from the September 1929 peak to the eventual bottom was 89%! The lesson, I think, is to stick to your strategy and not let emotions overwhelm you. That’s one of the purposes of our WealthProtect System; to take some of the emotion out of market decisions.

Stay healthy, and please call us if you have any questions.

Thanks for your continued trust.