WealthProtect Status Update: October 2017

Reginald A.T. Armstrong • WealthProtect Status Update

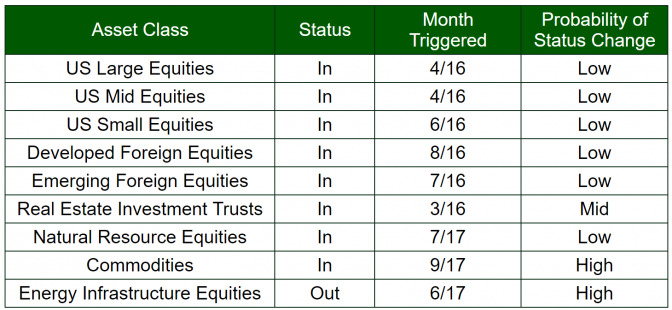

This is the monthly WealthProtect System* status update and includes the probability (Low, Mid, High) of a change in status within the next two months. Below is a commentary on actions taken this month as well as changes in overall asset allocation.

##System Commentary

There were no trade triggers this month. Stocks had a strong month, with small cap stocks and developed foreign stocks leading the way. Bonds and interest-rate sensitive stocks were broadly lower over the last 30 days, but modestly so. We remain out of energy infrastructure equities, but are closer to triggering in.

##Market Commentary

The peak of the market before the last crash was on 10/9/07, ten years ago. A 57% decline ensued until the bottom in March 2009. The US market finally broke back to even by 2012, followed by a strong US equity market in the last five years. Foreign stocks, however, have had a much more difficult time until this past year.

Now we have what many are calling a Teflon market. The market hasn't had a 5% decline since the bottom of the last correction in February of 2016—about 18 months. This is unusually long. Think about it: we have had Brexit, the US election, Trump tweets, failure to pass healthcare or tax reform yet, three hurricanes with devastating consequences, and the threat of nuclear conflagration. Yet, the market only yawns. This sort of complacency is dangerous. While we all enjoy having low volatility and statements that go up each month, volatility serves an important purpose. Just like small quakes help relieve stress along an earthquake fault line, so does market volatility help keep the "animal spirits" of investors in check. When everyone thinks the market can do nothing but go up is when bad things are likely to happen. Don't get complacent.

Keep your cool; stick to your strategy; call us if we can be of help.

Thanks for your continued trust.