WealthProtect Status Update October 2018

Reginald A.T. Armstrong • WealthProtect Status Update

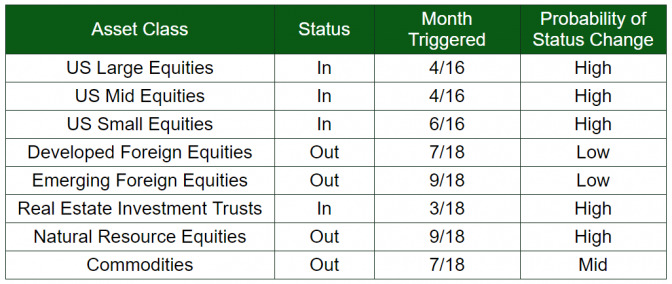

This is the monthly WealthProtect System* status update and includes the probability (Low, Mid, High) of a change in status within the next two months.

##System Commentary Despite a sharp drop on the 10th, our system did not trigger out of any other asset classes on our decision day of the 11th. That being said, all remaining asset classes are within a 2% drop of triggering out, with REITs being super close. Keep in mind that our system does not react on a daily basis, but only on a monthly basis. It is not designed to manage short-term volatility, but instead manage significant downside risk.

##Market Commentary

We have been saying for some time that the weakness in most asset classes except domestic stocks either meant a temporary adjustment or signaled bad times for US stocks eventually. Despite this recent drop seeming to confirm the latter, if US stocks stay above their long-term averages, this is still likely just a temporary drop. If US stocks do drop and stay under their average for a week or more, the likelihood that the tenor of the market has shifted to the negative is high. Keep in mind, on average the returns are 60% lower and the volatility 30% higher when the market is below its 10-month simple moving average.** Breaking that average is the equivalent of signaling a change in behavior of the market from mostly positive to mostly negative. We shall see.

Thanks for your continued trust and let us know if we can be of help.