WealthProtect Status Update October 2020

Reginald A.T. Armstrong • WealthProtect Status Update

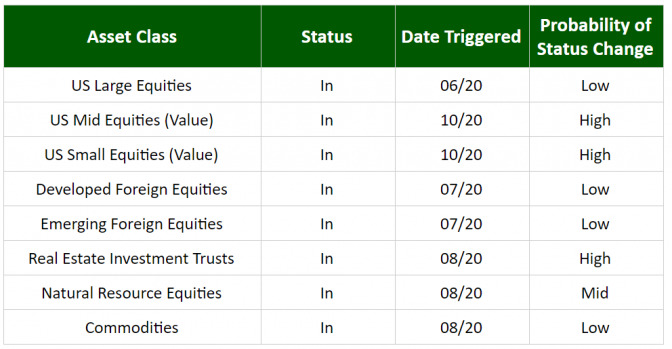

This is our monthly WealthProtect System* update, where we give probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

After dropping from September 2nd to the 23rd, the markets have bounced back up. This caused Small and Mid stocks to trigger back in. At mid-month, real estate crossed below the trigger line and then back up above.

Economic/Market Commentary

The third quarter gross domestic product increase should come in extraordinarily strong, above 30% growth based on the Atlanta Fed’s early estimate. Fourth quarter will likely be weaker, but still an increase. While the economy is still way below where it was 8-9 months ago, it appears that some of the concerns we had of bankruptcies piling up may thankfully not happen. So far, most bankruptcies have happened to companies that already had major problems. The recession likely just pulled the inevitable forward.

As earnings have continued to decline, the equity markets are now even more overvalued than they were a month ago. As I have mentioned many times, this is the second most expensive market in history. Market movements are like a pendulum; just because it has swung far in one direction doesn’t mean it can’t swing a bit further. But make no mistake, it is still a pendulum and will swing back eventually.

Sometimes it is helpful to take a longer view. If we look at the markets since January 26, 2018—where they hit a peak almost three years ago—we find that only a small part of the market has done well. Certainly, tech-heavy indexes have crushed it, but even the plain old S&P 500 is up only 17% through September 30th, 2020, from that date. The Dow Jones Industrial Average is up only about 4%. The equal-weight S&P 500 (meaning each stock is weighted equally instead of by size) is essentially flat.

Mid-size, small-size, foreign, and REITs are all down between 6% and 19% in that time. No wonder diversified portfolios have dragged. While adding to what is doing well is tempting, keep in mind that the pendulum here is also likely to swing. Moreover, the price action of the markets rhymes substantially with the price action of 1998-2000 when small caps began their downside two years before large stocks.

Portfolio Commentary

So, what do we do at this point with markets crossing trigger lines but the macro backdrop being risky and the election looming? While triggers have hit for mid, small, and REIT stocks, the internal relative strength indicates they may be due for a pullback. We will wait for that pullback as these positions keep vacillating. Still, our triggers have hit, so for our Classic Models we are adding a position in Large Cap Value and topping off our current Foreign Blend position. For our Christian Values Portfolio, we don’t have a large value option, so we are topping off our large company option.