WealthProtect Status Update: October 2021

Reginald A.T. Armstrong • WealthProtect Status Update

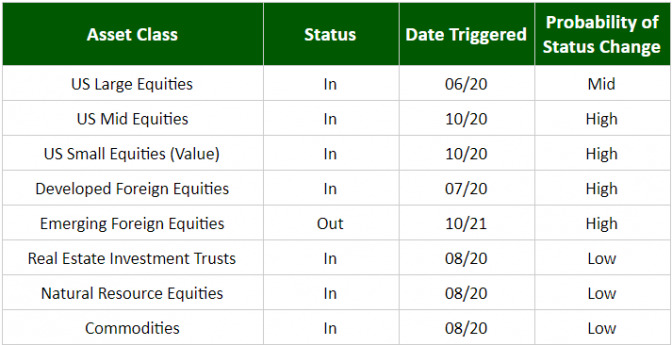

This is the monthly WealthProtect System* status update, where we include probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

Two changes. One, emerging markets triggered out. This does not affect any of our current models, although one of our foreign holdings does have some emerging market stocks and this could lead to us selling in the future. Two, while not listed above, we do track Gold using a two-year moving average which historically has indicated whether the metal is in a bull or bear market. This triggered out two weeks ago.

For our two most aggressive investment objectives we used the proceeds from the sale of gold to nibble on mid and small caps. These have been in a sideways consolidation pattern for six months and look close to breaking out. Despite an expensive market we want to be positioned for the upside. The consolidation has brought the trigger much closer to the investment price so if it should break to the downside, we should be able to exit with modest damage.

For the remainder of our investment objectives, which are more conservative, I have opted to stay cash-heavy for now.

Economic/Market Commentary

As of February 14th, the estimate of the Federal Reserve Bank of Atlanta for Third Quarter Gross Domestic Product (GDP) is 1.3%, a sharp slowdown from the approximate 6.5% growth in the first half of the year. Inflation is proving more persistent than expected. We are closely monitoring one of our indicators to see if the investment environment has shifted away from US equities and towards commodities in a decisive manner. If so, we would modify the portfolios appropriately.

Markets finally had a 5% pullback from their early September highs. Markets remain expensive, but we are entering the more favorable time of the year for the markets in a few weeks. We continue to monitor.

Thanks for your continued trust.