WealthProtect Status Update: October 2022

Reginald A.T. Armstrong • WealthProtect Status Update

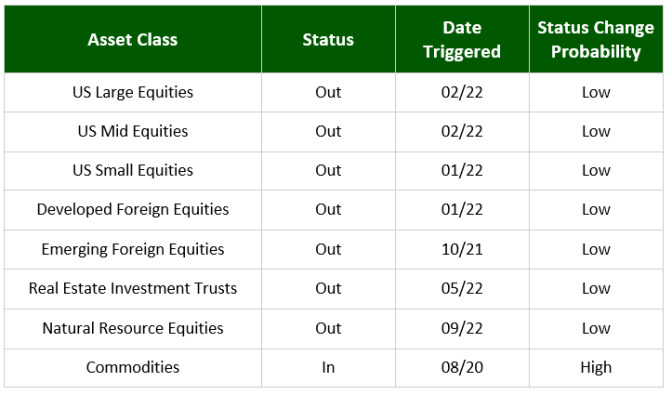

This is the monthly WealthProtect System* status update, where we include probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

No changes this month as stocks continued to move lower.

Economic/Market Commentary

Now that the bear market has lasted about 10 months, as of 10/12/22 stocks are down about 25%, bonds are down over 15%, and even gold is down over 9%. What is going on?

First, we are in a classic bear market as far as stocks go. What is unusual is that we are also in a bond bear market at the same time. This is not unprecedented but is unusual. Bonds have been hurt due to rising interest rates because of the Federal Reserve’s attempt to get ahead of inflation.

So, what likely happens next? After a possible rally, the next leg down for stocks will probably come from a drop in earnings. It is almost certain we are heading into a recession. As this reality takes hold, the fear of inflation will likely fade, and as stocks drop, bonds are most likely to rise. Bonds are very attractive here. There still may be some modest downside, but the majority of the damage is likely behind us. The increase in bond returns will be welcomed by conservative investors who have been hurt by this historically “safe” haven.

Finally, keep in mind that stocks are no longer nosebleed expensive. They are modestly expensive to the high end of fair value. As they continue to drop, stocks will become more attractive. That’s likely quite a few months out.

If the pain in your portfolio is keeping you up at night, please give your wealth manager a call.

Thanks for your continued trust.