WealthProtect Status Update: October 2023

Reginald A.T. Armstrong • WealthProtect Status Update

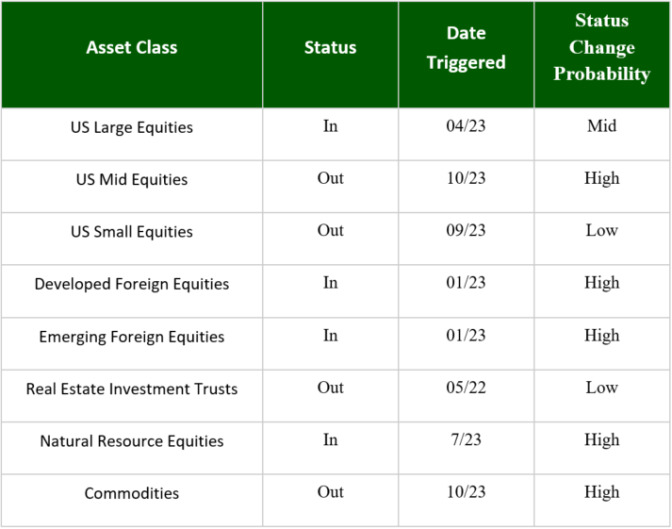

We email the status of our WealthProtect System* monthly and give the probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and the market in general.

System Commentary

Ongoing weakness caused midcap stocks and commodities to trigger out this month. This did not affect our models as don’t have specific investments in those asset classes currently. The market weakness caused all asset classes that are still “in” to move closer to their trigger point.

Economic/Market Commentary

Current economic data continues to be decent, while forward-looking data continues to suggest weakness ahead. We will continue to monitor. The August-September stock market consolidation has been very orderly. As third-quarter earnings come out, if they are at least decent, stocks should rally in the fourth quarter. This doesn’t change the fact that the market is overvalued. US Treasury yields rose significantly over the past two months making a cheap bond market even cheaper. Yields have dropped since the conflict in Israel began. This is bullish as it shows that US Treasuries continue to be viewed as a safe haven in times of turmoil. In addition, inflation seems to be coming down, although more slowly than many thought. Finally, short-term yields (CDs, money markets, US Treasury Bills) are likely close to their peak. Investors who are not satisfied with the interest they are earning on their “safe” money should discuss this with their wealth manager as there are several attractive options.

Thanks for your continued trust.