WealthProtect Status Update: September 2022

Reginald A.T. Armstrong • WealthProtect Status Update

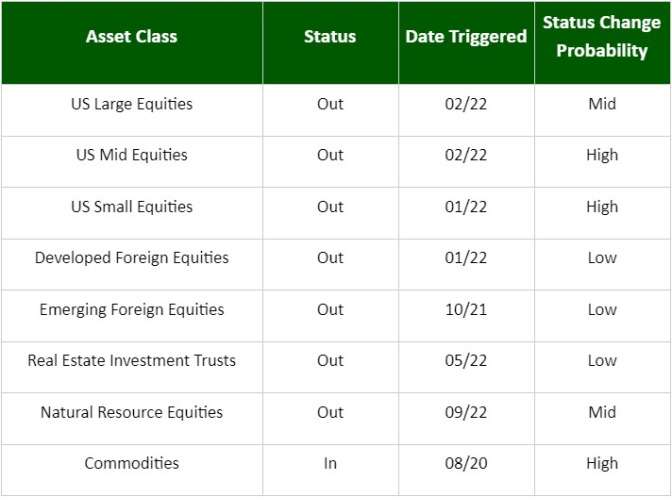

This is the monthly WealthProtect System* status update, where we include probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

In our classic models, we triggered out of our remaining large value holding and left the proceeds in cash. The strong rally from June 16 to August 16 rapidly faded as the market hit resistance at the 200-day moving average. This confirmed that this rally was a bear market rally and more downside, or at a minimum, volatility is to be expected. Additionally, while we don’t have an explicit natural resource stock position, those stocks triggered out as well. Bonds are very close to presenting a buying opportunity; we continue to monitor carefully.

Economic/Market Commentary

According to the Atlanta Federal Reserve Bank, expectations for GDP growth in the third quarter as of 9/8 are a positive 1.4%. That’s not recession (like the first half of the year), but it certainly isn’t robust growth.

When I review the risks facing investors, here is what I see as some of the most significant.

Persistent inflation. While inflation has likely peaked and will slowly come down, there is always the possibility it stays higher for longer. From 1966 to 1982, inflation averaged just over 7%.

Severe recession. We had a mild recession in the first half of the year; leading economic indicators and other data suggest a more severe recession could come in early 2023.

Chaos. The crazy jumps in energy prices in the Eurozone, along with shortages and price controls raises the specter of a cascading negative event that we can’t predict.

Deepening bear market. All the above can contribute to a deepening of the current bear market. Keep in mind that while stocks are no longer frothy like in December, they are still expensive.

Of course, we could have the war in Ukraine end, inflation drop, confidence rebound, and equities get back to their winning ways. I just don’t see that as the most likely course, but we will manage your portfolio by what is happening, not what we think should happen.

Thanks for your continued trust.