WealthProtect Status Update: September 2023

Reginald A.T. Armstrong • WealthProtect Status Update

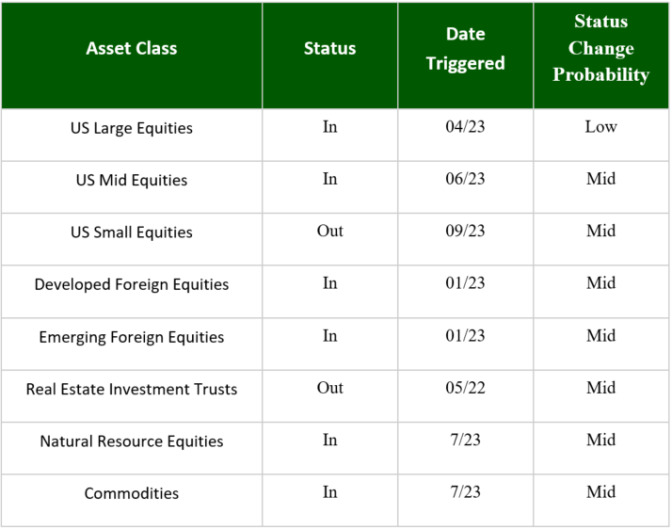

We email the status of our WealthProtect System* monthly and give the probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and the market in general.

System Commentary

Small cap stocks triggered out as the August-September correction has hit smaller stocks harder than large ones. Therefore, in many of our models we shifted out of small value stocks into an equally weighted large company investment. We opted to add to this instead of moving the proceeds to US Treasury Bills because this market correction has been very orderly. Despite being expensive, the odds of a push higher going to year-end seems likely.

Economic/Market Commentary

We continue to believe that a recession is likely, just delayed. I won’t reiterate all the reasons this month. On the market front, while stocks are up this year even after the recent correction, the gains are very narrow. For example, as of three weeks ago, the S&P 500 was up about 15% for the year. However, if you take out the top 7 stocks, the other 493 were up only 4%. This is not the sign of a healthy market. Still, as I mentioned above, the correction has been rather orderly, so this is likely a consolidation. If the market pushes higher to year-end, it is also likely that there will be greater participation in the advance. We continue, since the market is expensive, to monitor for any signs that things are coming apart at the seams.

Thanks for your continued trust.